Gold remains a cornerstone of global wealth and security. As 2025 unfolds, investors and buyers are closely watching gold price movements, market trends, and the opportunities these present. This guide explores the latest data, expert forecasts, and essential strategies for maximizing returns in the world of gold investing.

Table of Contents

- 2025 Gold Price Forecast

- Key Factors Affecting Gold Prices

- Regional Insights: Africa, DRC, & Uganda

- Major Investment Opportunities

- Risks & How to Mitigate Them

- Frequently Asked Questions

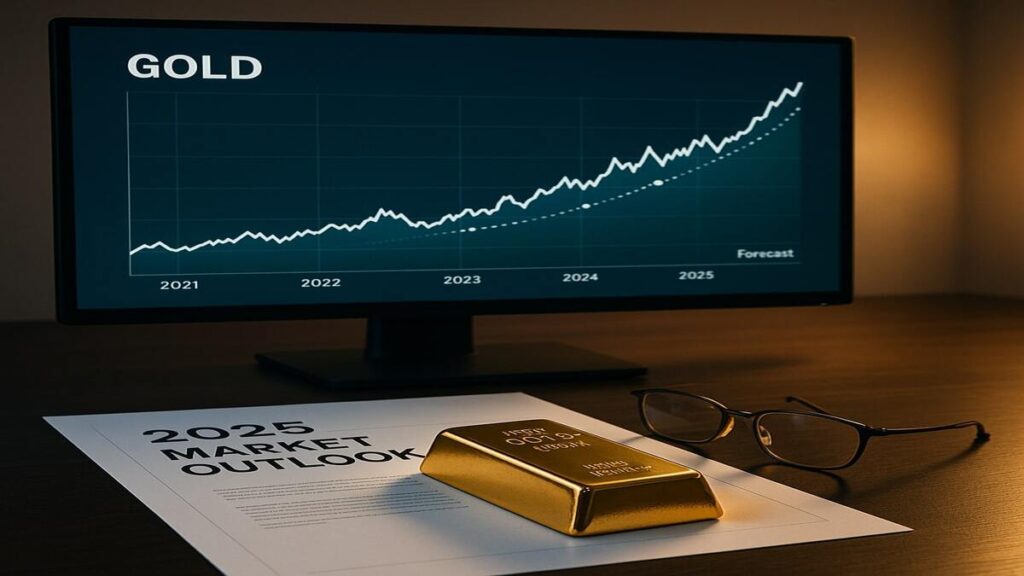

2025 Gold Price Forecast

Industry experts predict that gold prices will rise steadily throughout 2025 due to ongoing global volatility, inflation concerns, and increasing demand from central banks and individual investors. Analysts forecast an average price range of $2,100 to $2,400 per ounce, hitting new highs by year-end.

- Global events—including elections, trade disputes, and interest rate policies—will play a major role.

- Emerging markets are showing strong appetite for gold, especially in Africa, China, and India.

Key Factors Affecting Gold Prices

- Inflation: Persistent inflation pressures drive buyers towards gold as a safe haven.

- Currency Fluctuations: USD weakness often signals price increases in gold.

- Geopolitical Tensions: Conflicts and uncertainty boost demand for physical gold.

- Mining Supply: Limited new supply, especially from responsible sourcing in Africa, keeps prices elevated.

Regional Insights: Africa, DRC, & Uganda

African gold—particularly from DRC and Uganda—is highly sought after for its purity and ethical sourcing standards. Congo Rare Minerals is at the forefront, offering traceable gold bars aligned with global compliance.

- African mining operations are expanding, promising greater market liquidity.

- Export regulations remain tight, making verified suppliers increasingly valuable.

Major Investment Opportunities

- Gold Bars & Bullion: Physical gold remains the top choice for investors seeking security.

- Digital Gold Trading: Apps and online platforms now support instant gold purchases and sales.

- Gold-backed ETFs: For those preferring indirect exposure with lower entry barriers.

- Sustainable Mining: Investment in ethically sourced gold is growing fast, especially among institutional buyers.

Risks & How to Mitigate Them

- Counterfeit Gold: Mitigate by demanding certifications and using trusted suppliers like Congo Rare Minerals.

- Volatility: Diversify between physical gold, ETFs, and mining stocks.

- Regulatory Changes: Monitor global trade laws and import/export policies regularly.

Frequently Asked Questions

Q: Will gold prices continue to rise in 2025?

A: Most forecasts point towards a steady rise, driven by inflation and market uncertainty.

Q: What’s the safest way to invest in gold?

A: Buy from certified, reputable suppliers and consider diversifying with digital gold.

Q: Is African gold a good investment?

A: Yes—especially when sourced from compliant companies in DRC and Uganda, offering purity and ethical guarantees.

Calls-to-Action (CTA):

Ready to invest? Contact Congo Rare Minerals for market insights, certified gold, and exclusive opportunities today!