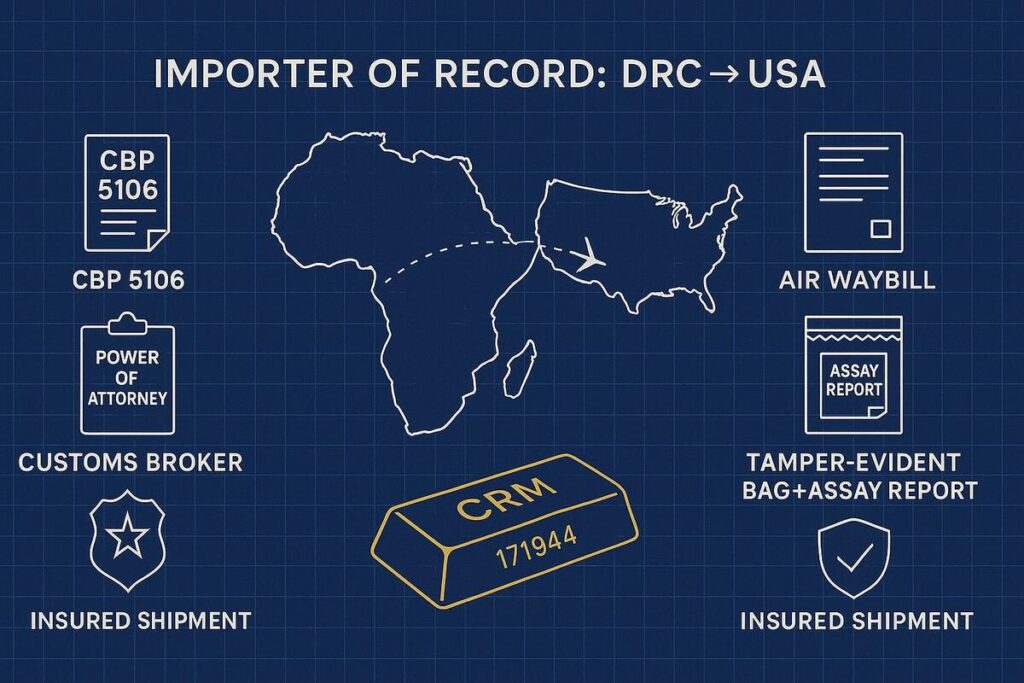

Buying mine-direct is only half the job. Your shipment still needs to clear U.S. Customs and Border Protection. This guide explains the Importer of Record role in plain English so a private buyer can move a shipment from the DRC to a U.S. vault or address with confidence.

Importer of Record, explained

The Importer of Record (IOR) is the party responsible for making entry with U.S. Customs, paying any duties and fees, and ensuring the shipment complies with all laws. The IOR can be you as an individual, your company, or a customs broker acting as your agent.

What the IOR must do

- Appoint a licensed customs broker for entry filing

- Provide identity details and sign a CBP Power of Attorney

- Supply accurate values, tariff classifications and documents

- Pay duties, taxes, and fees due at entry

- Keep records

Can a private buyer be the IOR?

Yes. You can act as IOR in your personal name or via your company.

Basic setup

- Importer Number: Individuals can use SSN. Companies use EIN.

- CBP Form 5106: Your broker uses this to register your importer data.

- Power of Attorney: Authorizes the broker to file entries for you.

- Customs Bond: Single-entry bond for one shipment or a continuous bond if you plan frequent imports.

Broker, courier, insurer: who does what

| Role | What they handle | What you provide |

|---|---|---|

| Customs broker | Entry filing, tariff classification at a high level, duty/fee calculation, communication with CBP | ID, POA, invoices, packing list, product details, delivery instructions |

| Courier / freight | Air waybill, pickup, linehaul, delivery | Delivery address or vault details, receiver contact |

| Insurer | All-risk coverage for declared value | Declared value, route, named parties |

| Seller (CRM) | Commercial invoice, export permits, assay, serial list, chain-of-custody docs | Your order details and KYC documents |

Tariff classification and duty at a glance

Your broker will classify the goods within HS Chapter 71 (Gold). Classification depends on form and use, for example unwrought bars versus coins. Many forms of monetary gold enter duty-free in the USA. Fees such as the Merchandise Processing Fee may still apply on some entries. Always confirm your exact classification and charges with your broker before payment.

Tip: Share clear product details with the broker early. Provide photos, fineness, weights, and whether the goods are investment bars or other forms.

Taxes, fees, and common costs

- Duty: Often 0% for monetary gold. Confirm with your broker.

- Merchandise Processing Fee (MPF): May apply on formal entries.

- State or local taxes: Vary by delivery state and transaction specifics.

- Brokerage: Entry filing and disbursement fees.

- Bond: Single-entry or annual continuous bond.

- Delivery: Final mile to vault or address.

Incoterms and risk transfer

Agree the term in writing with the seller. Common setups for precious metals include:

- CIP Named Place (carriage and insurance paid)

- DAP Named Place (delivered at place, buyer handles import)

- DPU Named Place (delivered and unloaded at a facility)

Your term defines who pays which costs and where risk transfers. Ask your broker to review the term so entry filing matches the paperwork.

The document pack you should expect

| Document | Why it matters |

|---|---|

| Commercial Invoice | Declared value, buyer and seller, currency, terms |

| Packing List | Units, weights, parcel count |

| Assay Card or Report | Fineness and weight confirmation |

| Serial Number List | Matches physical bars to documents |

| DRC Export Permit(s) | Confirms lawful export from origin |

| Insurance Confirmation | Policy number, declared value, territorial limits |

| Air Waybill (AWB) | Courier acceptance and tracking |

| Broker Instruction Letter | Your authorization, delivery location, contact |

| CBP POA and 5106 | Lets the broker file entry as your agent |

Keep scans of everything. Your broker may ask for additional details depending on classification and shipment value.

Pre-clearance timeline (typical air shipment)

- Quote accepted

You confirm quantity, purity, destination and pricing trigger. - Broker engaged

You sign POA, submit ID, and complete the 5106. Broker estimates duty, fees, bond, and delivery. - Booking + insurance

Seller books the courier and issues the insurance confirmation. You receive AWB and seal numbers. - Pre-file with CBP

Broker files entry data once the AWB is created and documents are complete. - Arrival and inspection

Shipment arrives, CBP may release on documents or route for exam. - Duties and fees paid

Broker pays on your behalf and invoices you. - Final mile

Delivery to your vault or address by appointment. Unbox with a verification checklist and keep all packaging until you confirm serials and weights.

Red flags to avoid

- No broker involved and no importer number

- “Fully insured” with no policy number or declared value

- Declared value does not match your invoice

- Missing serial lists or assay documentation

- Inconsistent names or addresses across invoice, AWB, and insurance

- Pressure to accept delivery without time to verify contents

IOR readiness checklist

- Importer number ready (SSN or EIN)

- Customs broker appointed and POA signed

- 5106 completed

- Bond arranged

- Incoterm agreed with seller

- Full document pack received before funds are released

- Delivery point confirmed: vault or address

- Verification plan ready for delivery day

Frequently asked questions

Can my broker act as the Importer of Record for me?

Yes, brokers can act as your agent for entry, but you remain responsible for accuracy and payment. Some brokers can serve as the nominal IOR in limited cases. Ask your broker how they prefer to structure the entry.

Do I need a continuous bond?

If you plan frequent imports, a continuous bond can be cheaper and simpler than buying a bond each time. For a one-off shipment, a single-entry bond usually works.

Is there sales tax on gold when importing into the USA?

Import duty is often zero for monetary gold, but state or local taxes and fees can apply depending on where and how you take delivery. Ask your broker and tax adviser about your state.

Will CBP open my package?

CBP can examine any import. Proper packing, clear documents, and a responsive broker help reduce delays.

Can you deliver straight to a depository?

Yes. Many buyers choose direct vault delivery. Provide your vault details early so the courier and broker can book the correct service.

What if the shipment is delayed or lost?

Notify the broker and insurer immediately. Keep packaging, photos, and tracking. Claims use your invoice, AWB, seal numbers, and insurance certificate.