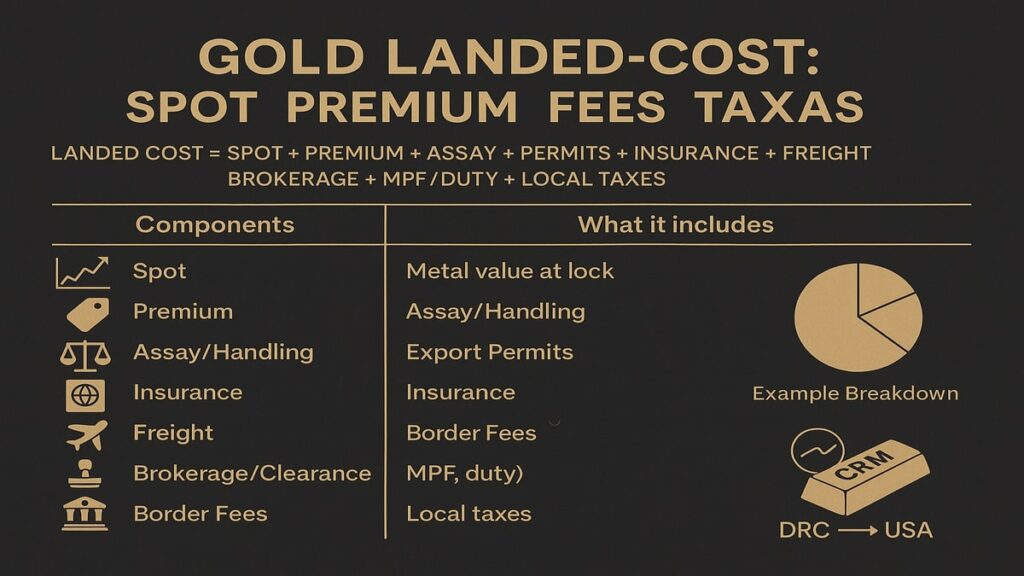

Why landed cost is the only number that matters

The price on your invoice is not just spot plus a premium. The final figure at your door or vault includes services that move and protect the bar: assay, permits, insurance, courier, brokerage, and border fees. When you compare suppliers, compare like for like landed cost to your ZIP and delivery method, not just the premium.

The formula

Landed Cost = Metal Value at Lock + Premium + Assay/Handling + Export Permits + Insurance + Freight + Brokerage/Clearance + Border Fees (MPF, duty) + Local taxes or fees

- Metal value = spot at the agreed pricing trigger × fine weight

- Premium = supplier margin and manufacturing costs

- Assay/handling and permits = documentation and origin compliance

- Insurance = usually a small percent of declared value

- Freight = courier linehaul to your vault or address

- Brokerage = customs entry filing and disbursements

- Border fees

- MPF for most formal entries is 0.3464% ad valorem with a published minimum and maximum that CBP adjusts for inflation. For FY2025 the minimum is $32.71 and maximum $634.62. CBP has announced new bounds effective Oct 1, 2025: $33.58 minimum and $651.50 maximum. (CBP Help)

- Duty on monetary gold: CBP states no duty on gold coins, medals, or bullion, though all imports must be declared. Always confirm classification and any state or local taxes with your broker. (CBP Help)

Note on 2025 developments: CBP and the White House issued updates around tariff classification codes for gold bars. Policy direction has favored zero tariffs for certain codes and partner countries, but correct HTS classification remains critical. Confirm the latest ruling and code with your broker before shipment. (Reuters)

What drives the number up or down

- Bar size and purity

- Quantity and consolidation

- Route and delivery type (vault vs address)

- Insurance rate and coverage limits

- Entry type and MPF min or max

- Market move between quote and payment

Worked examples (illustrative)

Assume spot equals USD 80,000 per kg for simple math. These are examples, not live offers.

Example A — 1 kg bar to New York, vault delivery

| Line item | Basis | Amount |

|---|---|---|

| Metal value | Spot at lock | 80,000.00 |

| Premium | Fixed per 1 kg | 1,200.00 |

| Assay & handling | Fixed | 150.00 |

| Export permits/docs | Fixed | 800.00 |

| Insurance | 0.8% of declared value | 657.20 |

| Courier freight | Route dependent | 600.00 |

| US customs brokerage | Fixed | 450.00 |

| MPF | 0.3464% of declared value | 284.57 |

| Illustrative landed cost | 83,141.77 |

Example B — 10 × 100 g bars to Los Angeles, home delivery

| Line item | Basis | Amount |

|---|---|---|

| Metal value | Spot at lock | 80,000.00 |

| Premium | Higher on small bars | 1,800.00 |

| Assay & handling | Fixed | 300.00 |

| Export permits/docs | Fixed | 800.00 |

| Insurance | 0.9% of declared value | 746.10 |

| Courier freight | Multiple parcels | 850.00 |

| US customs brokerage | Fixed | 450.00 |

| MPF | 0.3464% of declared value | 287.17 |

| Illustrative landed cost | 85,233.27 |

Example C — 5 kg consolidated to Miami, vault delivery

| Line item | Basis | Amount |

|---|---|---|

| Metal value | Spot at lock | 400,000.00 |

| Premium | 1,100 × 5 kg | 5,500.00 |

| Assay & handling | Fixed | 500.00 |

| Export permits/docs | Fixed | 1,200.00 |

| Insurance | 0.7% of declared value | 2,850.40 |

| Courier freight | Consolidated | 1,500.00 |

| US customs brokerage | Fixed | 600.00 |

| MPF | 0.3464% of declared value | 1,410.54 |

| Illustrative landed cost | 413,560.94 |

Declared value equals metal value plus premium and document charges prior to insurance.

How to compare quotes fairly

- Ask for a line-item quote that lists every fee.

- Confirm pricing trigger and validity window.

- Check the insurance policy reference, risk transfer point, and per-parcel limit.

- Ask which HTS code your shipment will use and have your broker confirm.

- Request a broker-ready document pack before payment.

- Compare landed cost to your specific ZIP and delivery method, not to a generic rate.

Common mistakes and how to avoid them

- Comparing only premiums, not total landed cost

- Assuming MPF is zero or using the wrong min or max bracket

- Using the wrong HTS code and creating tariff risk

- Undervaluing the declared amount and voiding insurance

- Forgetting final-mile costs to a vault or address

- Not locking spot in writing

FAQ

Is there import duty on gold bars into the USA?

CBP guidance says there is no duty on gold coins, medals, or bullion. Classification still matters and policy updates can affect specific codes. Confirm with your broker for your product and origin. (CBP Help)

What is the MPF and how much is it?

MPF is a Customs user fee for most formal entries. The ad valorem rate is 0.3464% with a published minimum and maximum that CBP adjusts annually. FY2025 min $32.71 and max $634.62. From Oct 1, 2025 CBP states min $33.58 and max $651.50. (CBP Help)

Do state taxes apply when gold is delivered to me?

Some states exempt certain bullion. Others may apply sales or use tax depending on the product and transaction. Ask your broker and tax adviser for your state rules.

Does vault delivery change the math?

Often yes. Vault delivery can reduce handling risk and may change final-mile costs and insurance terms. Your quote should show both options.

Can I make my own calculator?

Yes. Use the formula above and add the current MPF min or max if the percentage falls outside the band.