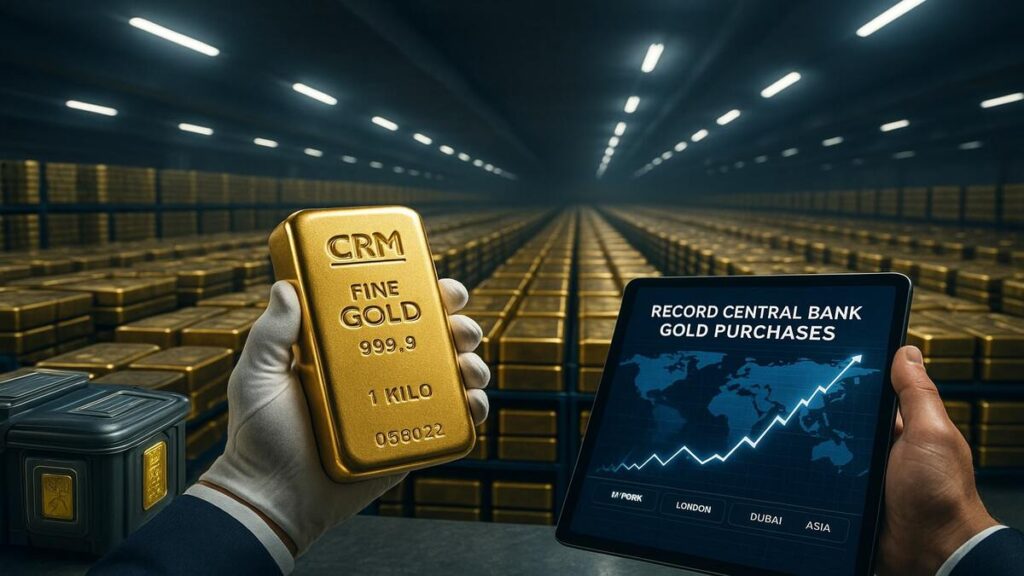

Around the world, central banks are quietly stockpiling gold bars.

From Beijing to Moscow, Ankara to Warsaw, official institutions are building record gold reserves – a clear signal that gold remains the ultimate safe-haven asset in today’s uncertain global economy.

But what does this trend mean for private investors? If the world’s most powerful financial institutions are increasing their bullion holdings, perhaps it’s time for individuals to learn the same lesson.

At Congo Rare Minerals (CRM), we help investors mirror the strategies of central banks by securing LBMA-certified 24K gold bars directly from mine to vault.

1. The Surge in Central Bank Gold Buying

- In 2022 and 2023, central banks bought gold at the fastest pace in over 50 years.

- The People’s Bank of China has consistently added tonnes of bullion to its reserves.

- Countries like Turkey, India, and Russia are diversifying away from the U.S. dollar.

💡 According to the World Gold Council, central banks bought more than 1,100 tonnes in 2023 alone – a record since the 1970s.

2. Why Central Banks Trust Gold

Central banks don’t buy based on speculation – they buy for stability. Their key reasons mirror those of smart private investors:

- Hedge Against Inflation – Gold protects purchasing power as currencies weaken.

- Diversification – Reduces reliance on fiat currencies like the dollar or euro.

- Crisis Insurance – Gold performs during financial shocks, wars, or political uncertainty.

- No Counterparty Risk – Unlike bonds or equities, gold is a tangible reserve asset.

💡 When the U.S. dollar faces volatility, gold becomes the anchor for monetary stability.

3. Lessons for Private Investors

What central banks do at the institutional level, you can do at the personal level:

- ✅ Allocate a percentage of your portfolio to physical bullion.

- ✅ Favor 1kg gold bars for efficiency and liquidity.

- ✅ Use secure vaulting in financial hubs like Dubai or Zurich.

- ✅ Treat gold as a long-term wealth anchor, not a short-term trade.

💡 If the guardians of global finance see gold as essential, it makes sense for individuals to follow their lead.

4. Institutional Gold Investment vs. Private Gold Investment

- Central Banks: Buy in tonnes, stored in national vaults.

- Investors: Buy in bars and coins, stored privately or at trusted vaults.

- Similarity: Both aim to preserve value during global turbulence.

5. How Congo Rare Minerals Empowers Investors

At CRM, we bridge the gap between central bank strategies and private investor access:

- 🏆 Mine-Direct Sourcing – DRC’s largest exporter of certified bullion.

- 📜 LBMA-Certified 24K Bars – Global recognition and liquidity.

- 🌍 Vault Network – Zurich, Dubai, Kampala.

- 🔒 Insured Logistics – Secure delivery worldwide.

- ♻️ Buyback Guarantee – Liquidity whenever you need to sell.

✅ Key Takeaways

- Central banks are buying record levels of gold bars for stability and protection.

- The reasons – inflation hedge, diversification, safe haven demand – apply equally to private investors.

- Congo Rare Minerals makes these same institutional-grade bullion strategies available to individuals worldwide.

Conclusion

Central banks aren’t chasing trends – they’re securing the world’s oldest form of money against modern risks.

For investors, the lesson is clear: If global financial guardians are buying gold bars, so should you.

With Congo Rare Minerals, you gain access to the same level of security, purity, and global liquidity trusted by central banks – delivered directly to you.

Next Step: Secure LBMA-Certified Gold Bars – Invest like the world’s most powerful financial institutions.